USD/INR Price News: Indian rupee picks up bids above 73.00, jostles with nearby hurdles

- USD/INR fades bounce off two-month low, refreshes intraday bottom.

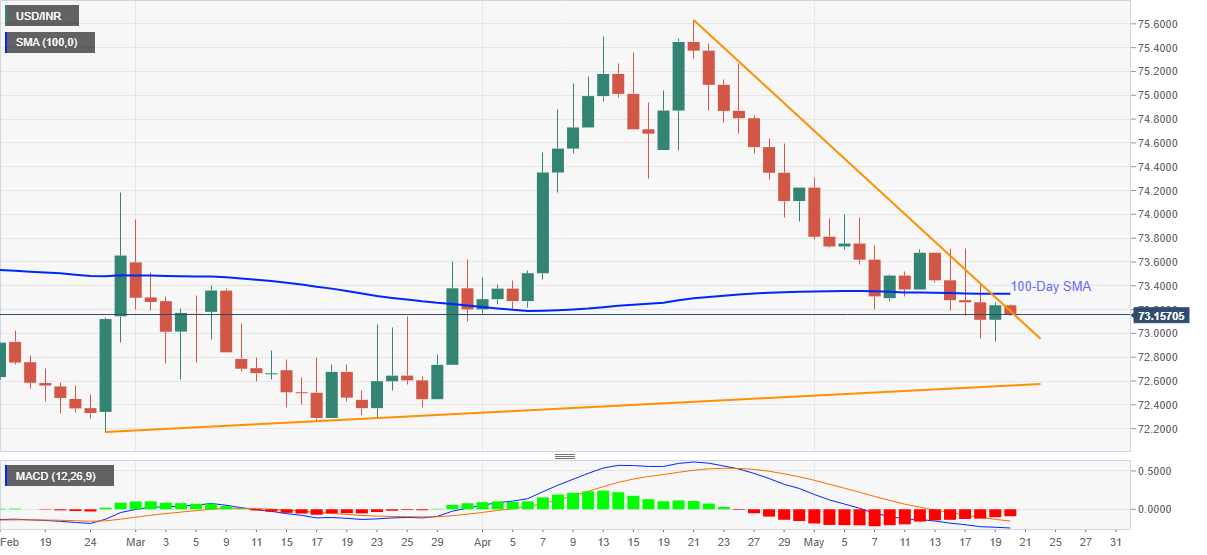

- Bearish MACD, failures to cross immediate resistances favor sellers.

- 100-day SMA adds to the upside barriers, 72.80 lures bears.

USD/INR takes offers around 73.15, down 0.11% intraday, amid the initial Indian trading session on Thursday. In doing so, the quote rejects the previous day piercing off a downward sloping trend line from April 21, not to forget staying below 100-day SMA.

Given the bearish MACD and the pair’s failures to cross the key resistances, USD/INR stays on the seller’s radar with the 73.00 actings as immediate support to watch during the further weakness.

It should, however, be noted that multiple tops marked during March, around 72.80, could probe the pair’s downside before directing USD/INR bears to toward a three-month-old support line near 72.55.

Meanwhile, clear trading beyond the 100-day SMA level of 73.33 may recall 73.70 and the 74.00 round figure on the chart.

Though, February’s high near 74.18 and mid-April low close to 74.30 will be tough resistances to break for USD/INR bulls past 74.00.

Overall, USD/INR remains on the bearish trajectory.

USD/INR daily chart

Trend: Bearish