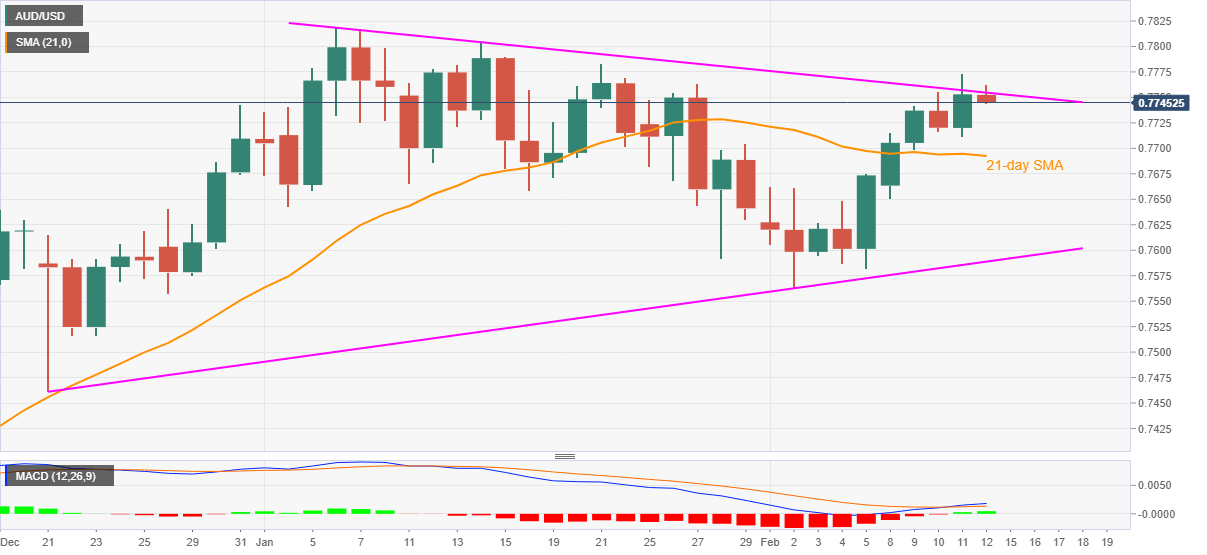

AUD/USD Price Analysis: Stretches pullback from key resistance line above 0.7700

- AUD/USD stays depressed around mid-0.7700s after its U-turn from three-week top.

- MACD remains strong, sustained trading above 21-day SMA also favor bulls.

- Sellers need to break ascending trend line from December 21 to retake controls.

AUD/USD drops to 0.7745, intraday low of 0.7744, during the early Friday. The pair recently eased amid calls of a five-day lockdown in Victoria.

In doing so, the quote extends its U-turn from a downward sloping trend line from January 06. However, bullish MACD and successful trading above 21-day SMA keeps the AUD/USD buyers hopeful.

The currently consolidation may eye 21-day SMA, at 0.7692 now, but any further weakness will have to slip beneath an eight-week-old rising support line, currently around 0.7588, to convince the AUD/USD sellers.

Following that, the monthly low of 0.7562 can offer a mild rest-point to the bears targeting a sub-0.7500 area.

On the flips side, a clear break above 0.7755 will target the yearly top near 0.7820. It should, however, be noted that the AUD/USD bull can easily jump above 0.7900 during the run-up beyond 0.7820 to target March 2018 top near 0.7920.

AUD/USD daily chart

Trend: Pullback expected