EUR/NOK bounces off lows, back near 10.4000

- EUR/NOK moves to 3-day highs near the 10.40 level.

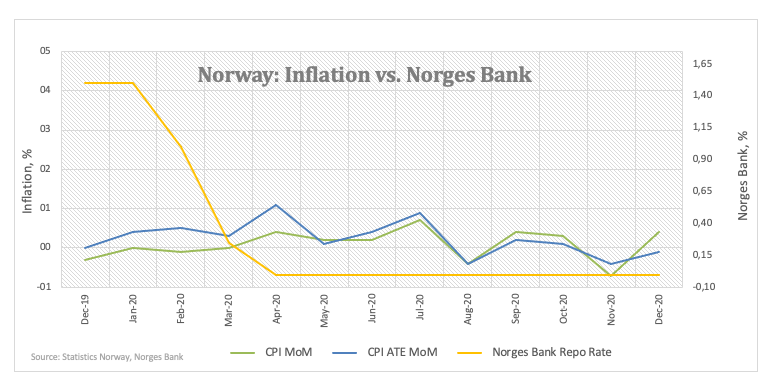

- Norway’s headline CPI rose 0.4% MoM in December.

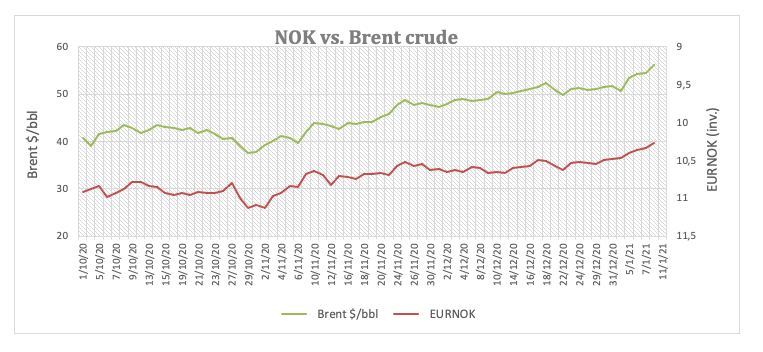

- NOK keeps looking to crude oil for direction.

The Norwegian krone loses some of its recent shine and lifts EUR/NOK to new 3-day highs in the 10.40/41 region at the beginning of the week.

EUR/NOK looks to oil, data

Following seven consecutive daily pullbacks, EUR/NOK is now posting some decent gains on the back of fresh selling pressure hitting the krone amidst the corrective leg lower in crude oil prices and the move higher in the US dollar.

In fact, the barrel of the European benchmark Brent crude gives away part of the recent sharp upside and recedes to the proximity of the $55.00 mark, all against the backdrop of a moderate rebound in the buck.

In the data space, inflation figures in Norway showed the headline CPI rose 0.4% inter-month during December, while the CPI-ATE (CPI adjusted for tax changes and excluding energy products) contracted at a monthly 0.1%.

EUR/NOK significant levels

As of writing the cross is gaining 1.41% at 10.4174 and faces the next up barrier at 10.5072 (21-day SMA) followed by 10.6586 (55-day SMA) and then 10.7799 (monthly high Dec.7 2020). On the downside, a breach of 10.2689 (2021 low Jan.8) would expose 10.0042 (monthly low Feb.17 2020) and finally 9.8163 (2020 low Jan.2).