EUR/USD flirts with the 55-day SMA near 1.1790

- EUR/USD keeps the buying bias unchanged near 1.1780.

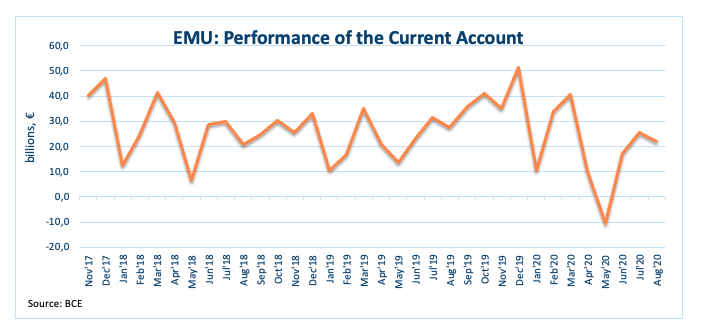

- EMU’s Current Account surplus widened to €21.8 billion in August.

- US Building Permits, Housing Starts, Fedspeak next in the calendar.

The single currency keeps the positive momentum well and sound for yet another session and pushes EUR/USD to the 1.1780/90 band, where also sits the 55-day SMA.

EUR/USD supported by risk trends

EUR/USD advances for the third session in a row on Tuesday although a visit to the 1.18 neighbourhood still remains elusive for euro-bulls.

In the meantime, market sentiment remains supportive of the risk complex amidst steady hopes that US policymakers could finally deliver an extra package of fiscal stimulus in the near term.

On the other hand, the unremitting advance of the coronavirus pandemic in Europe continues to weigh on the investors’ morale and the incipient economic recovery, somewhat limiting the potential upside.

In the euro docket, the Current Account surplus shrunk to €21.8 billion during August (from €25.5 billion). Later in the US data sphere, Building Permits and Housing Starts will take centre stage along with speeches by FOMC’s Quarles and Evans.

What to look for around EUR

EUR/USD extends the bounce off last week’s lows in the 1.1690/85 band and keeps targeting the area of recent peaks around 1.1830. The outlook on EUR/USD still remains constructive and bearish moves are deemed as corrective only. Further out, the positive bias in the euro remains underpinned by auspicious results from domestic fundamentals (despite momentum appears somewhat mitigated in several regions), the so far cautious stance from the ECB and the solid position of the EMU’s current account. In addition, the probable “blue wave” following the US elections is deemed as a negative driver for the greenback and carries the potential to lend extra legs to the pair in the longer run.

EUR/USD levels to watch

At the moment, the pair is gaining 0.13% at 1.1784 and a breakout of 1.1830 (monthly high Oct.9) would target 1.1917 (high Sep.10) en route to 1.1965 (monthly high Aug.18). On the other hand, the next support is located at 1.1688 (monthly low Ot.15) followed by 1.1612 (monthly low Sep.25) and finally 1.1495 (monthly high Mar.9).