USD/INR Price News: Indian rupee sellers step back from 100-bar SMA

- USD/INR eases from 74.96 while flashing a three-day winning streak.

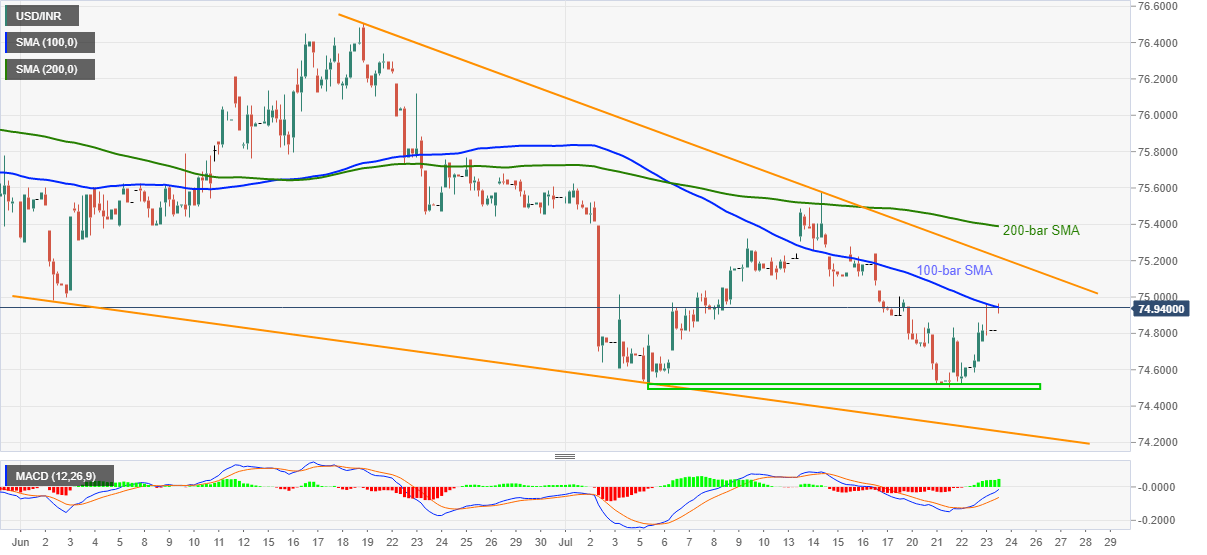

- Falling wedge formation, bullish MACD keep the pair buyers hopeful.

- Sellers will have to refresh monthly low for immediate justification of strength.

USD/INR recedes from 74.96 to 74.94 during the initial Indian session on Friday. In doing so, the pair takes a U-turn from 100-bar SMA despite flashing a third positive day and challenging the four-day high.

Although key SMA raises bars for the pair bulls around 74.95, bullish MACD and the pair’s bounce on Wednesday signal further upside. As a result, buyers may aim to confirm a bit broader falling wedge bullish technical pattern with an upside clearance of 75.21.

However, a 200-bar SMA level of 75.40 will validate the pair’s confirmation of the bullish play towards June month’s top near 76.50.

On the contrary, 74.80 may entertain short-term sellers ahead of testing them with 74.52/50 horizontal area comprising lows marked so far in the month.

Also acting as a downside filter is the lower line of the mentioned falling wedge, at 74.26 now.

USD/INR four-hour chart

Trend: Pullback expected