WTI Price Analysis: Bears firming up the grip towards immediate support lines under $40.00

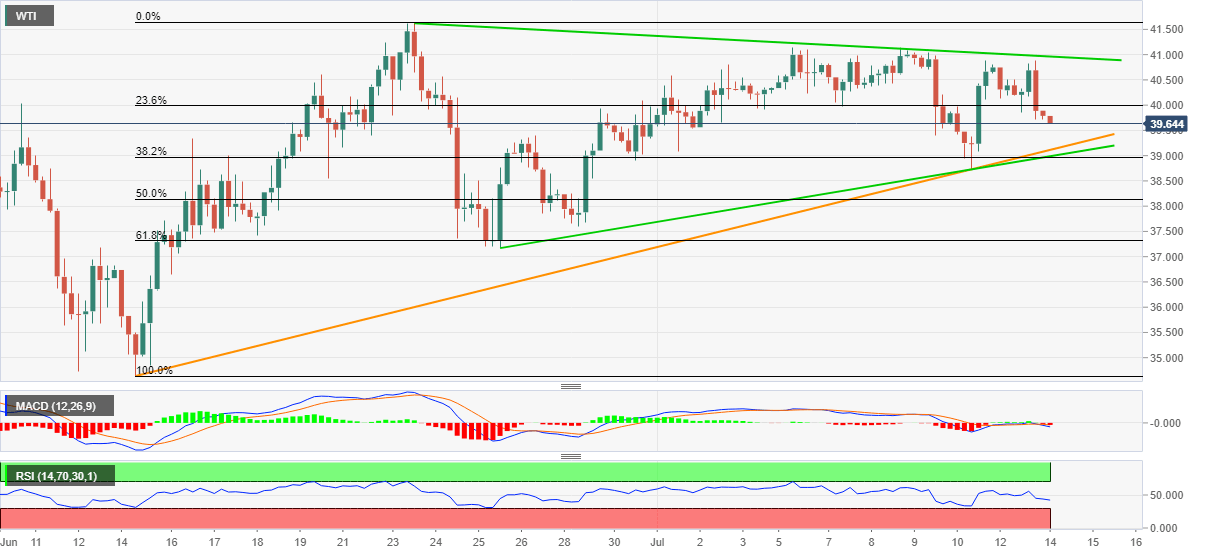

- WTI stays on the back foot after taking a U-turn from $40.87 the previous day.

- An ascending trend line from June 25, monthly support line are on the sellers’ radars.

- A three-week-old falling trend line restricts the pair’s immediate upside.

WTI drops to $39.70, down 0.20%, during the initial hour of Tokyo open on Tuesday. In doing so, the energy benchmark extends Monday’s weakness from $40.87 amid bearish MACD signals.

However, two short-term ascending trend lines, surrounding $39.10 and $39.00 respectively, seem to restrict the black gold’s further weakness.

If at all the oil prices slip below $39.00, 61.8% Fibonacci retracement of June 15-23 upside near $37.30 will be the key to follow.

On the upside, $40.00 and $40.20 can offer immediate resistance to the quote ahead of highlighting a downward sloping trend line from June 23, at $41.00 now.

It’s worth mentioning that the buyers’ ability to conquer $41.00 enables them to challenge the previous month’s top close to $41.65 with eyes on February month low near $44.00 during the further upside.

WTI four-hour chart

Trend: Further weakness expected