USD/INR Price News: Indian rupee alternate losses with gains above 75.00

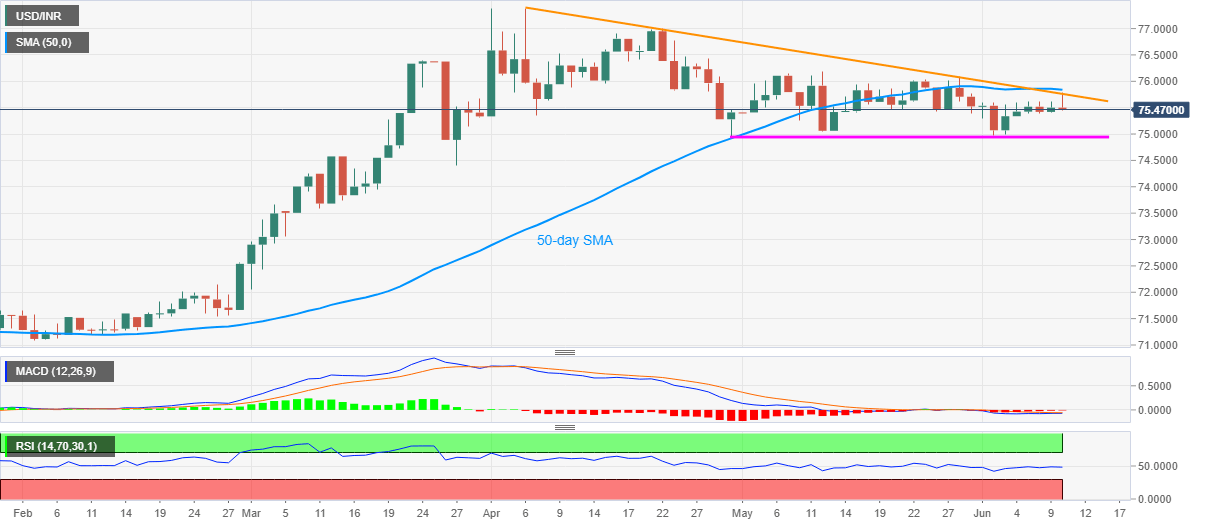

- USD/INR remains below a two-month-old falling trend line.

- Six-week-long horizontal support restricts the pair’s immediate downside.

- MACD, RSI indicate continuation of the choppy trading.

USD/INR fails to keep the bounce off 75.44 while retreating to 75.47 amid the initial Indian session on Wednesday. In doing so, the pair seems to cheer the broad US dollar weakness while stepping back from a downward sloping trend line stretched since April 06, 2020.

Considering the latest pullback from the key resistance, the quote is likely to extend the downside towards 75.00 round-figure. However, a horizontal area comprising lows marked from April 30, around 75.00-74.95 can limit the pair’s further weakness.

In a case where the bears portray a daily closing below 74.95, March 27 bottom surrounding 74.40 could return to the charts.

Alternatively, a 50-day SMA level of 75.84 acts as the additional resistance over the short-term falling trend line near 75.76. Furthermore, the May month high of 76.20 becomes an extra filter during the pair’s north-run beyond 75.76.

If at all the pair witnesses a daily closing beyond 75.76, it’s gradual rise towards the late-April high near 76.00 can’t be ruled out.

USD/INR daily chart

Trend: Sideways