EUR/USD Price Analysis: Buyers again aim for 1.0865/70 resistance confluence

- EUR/USD prints a three-day winning streak.

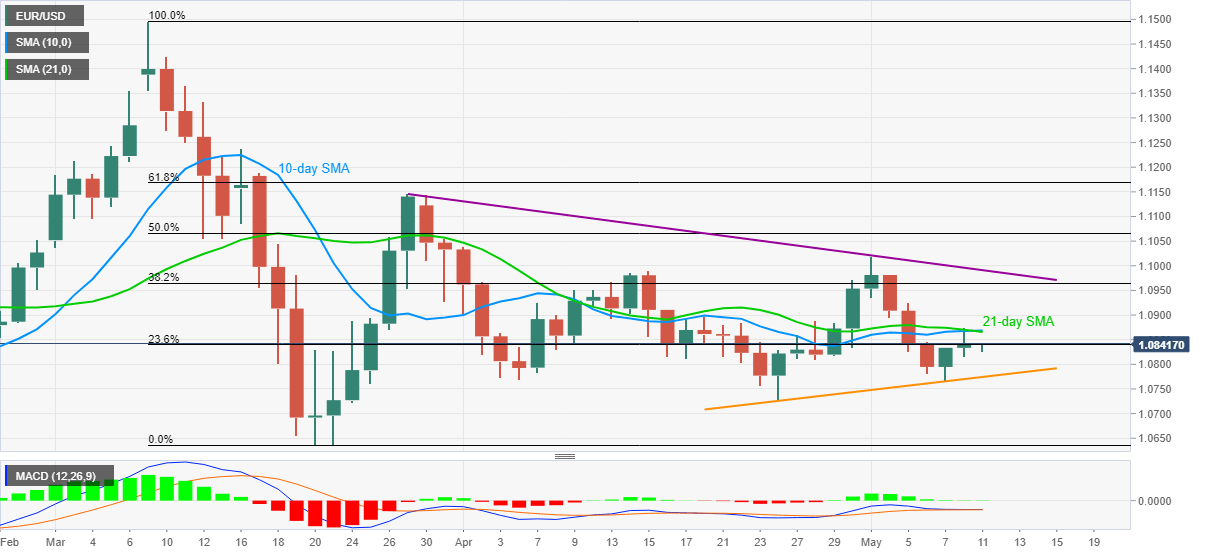

- 10/21-day SMAs restrict immediate upside.

- A two-week-old rising trend line limits short-term declines.

EUR/USD defies Friday’s pullback from key short-term SMAs while trading around 1.0843 amid Monday’s Asian session. In doing so, the pair again aims to confluence the short-term key resistance confluence near 1.0865/70.

Should buyers manage to hold the grip beyond 1.0870, 38.2% Fibonacci retracement of March month downside, near 1.0965, followed by a six-week-old falling trend line around 1.0991, becomes the key.

In a case where the bulls manage to justify their dominance above 1.0991, by clearing 1.1000 round-figure, the monthly high near 1.1020 will be quickly refreshed.

Alternatively, a short-term ascending trend line close to 1.0775 restricts the pairs’ immediate downside.

Given the pair’s inability to cross 1.1000 push the quote towards the sub-1.0775 area, the April monthly low near 1.0727 will be on their radars.

EUR/USD daily chart

Trend: Sideways to positive