Back

13 Mar 2020

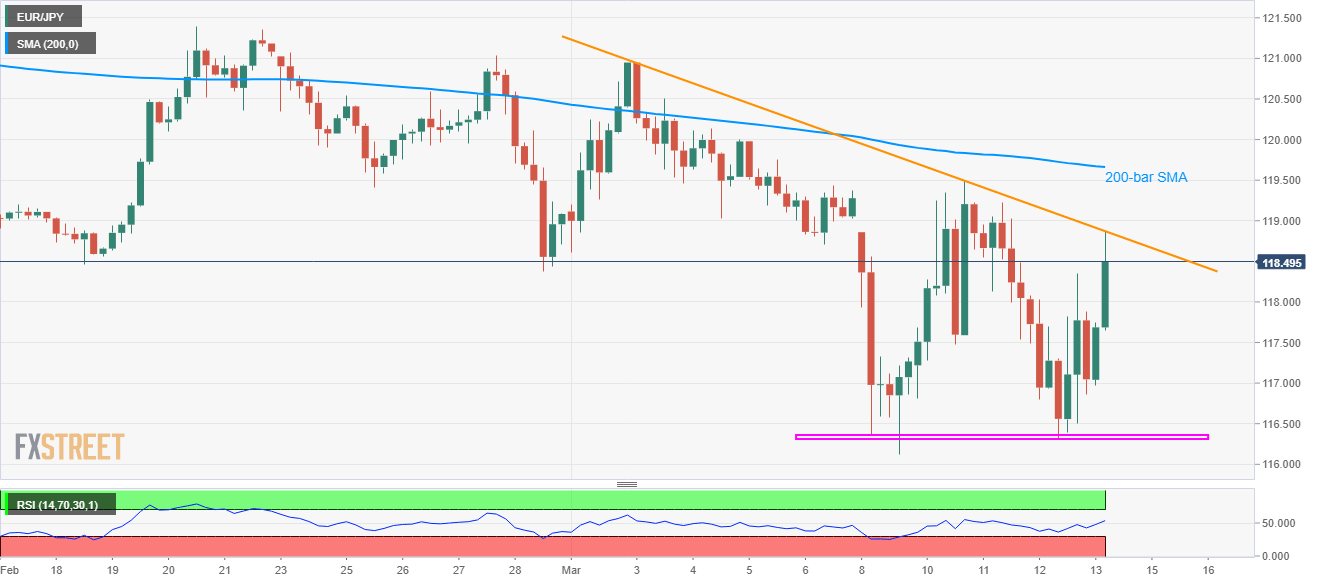

EUR/JPY Price Analysis: Strongly bid, probes monthly resistance trendline

- EUR/JPY registers strong gains on the BOJ’s action, risk reset.

- The monthly falling trend line, 200-bar SMA guard immediate upside.

- 116.35/30 offers strong downside support.

EUR/JPY takes the bids to 118.53, up 1.29%, ahead of the European open on Friday. The pair recently benefited from the BOJ’s liquidity infusion as well as a pullback in the early-day risk-off.

As a result, it confronts the short-term falling trend line, currently at 118.90, a break of which could challenge the weekly top near 119.50.

However, 200-bar SMA near 119.65 and 120.00 round-figure could challenge the bulls past-119.50.

Alternatively, 117.70 and 116.90 can works as immediate supports ahead of the 116.35/30 horizontal area.

In a case where the bears keep dominating past-116.35, traders the year 2019 low near 115.85 could return to the charts.

EUR/JPY four-hour chart

Trend: Pullback expected