GBP/JPY Price Analysis: 142.00 is the level to bear for bears

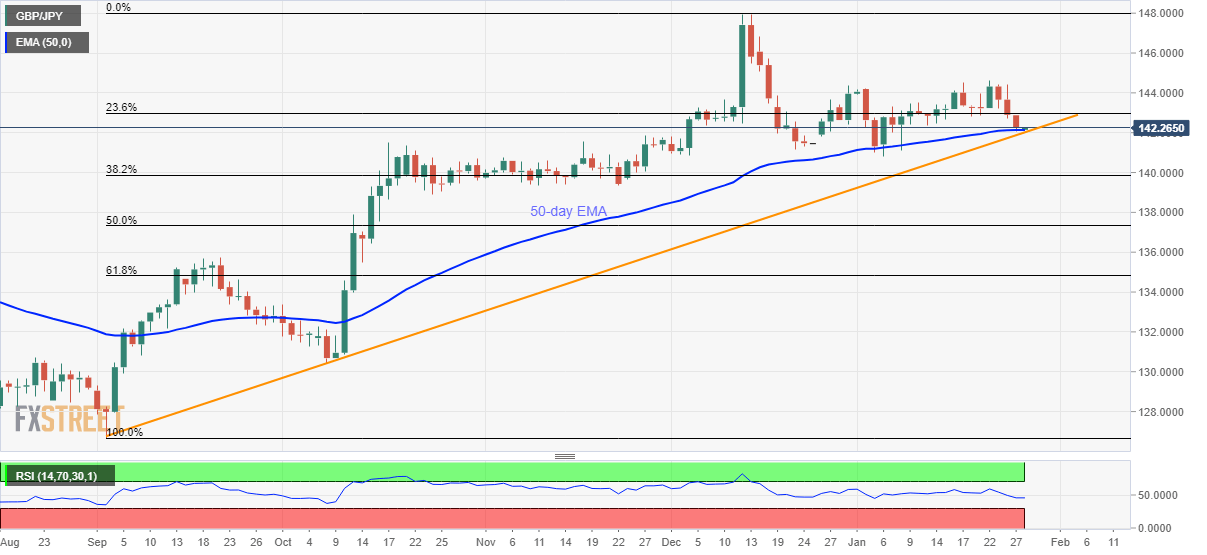

- GBP/JPY bounces off 50-day EMA.

- An ascending trend line from early September 2019 offers strong support.

- Last week’s high can lure the buyers.

GBP/JPY recovers to 142.30 by the press time of Tuesday’s Asian session. In doing so, the pair takes a U-turn from 50-day EMA, not to mention staying beyond a multi-month-old support line.

As a result, prices are likely to revisit 23.6% Fibonacci retracement of the pair’s September-December 2019 upside, near 143.00, during the additional pullback.

However, Wednesday’s top around 144.60 seems to cap the pair’s upside beyond 143.00, if not then its gradual run-up towards the previous month high surrounding 148.00 can’t be ruled out.

Alternatively, the aforementioned medium-term support line, close to 142.00, will validate the pair’s declines below the 50-day EMA level of 142.14.

With that, the bears could challenge the monthly low near 141.00 while targeting the 140.00 psychological magnet.

GBP/JPY daily chart

Trend: Pullback expected