Back

7 Nov 2018

GBP/USD Technical Analysis: Brexit hopes keeping the Cable pinned above 1.3100

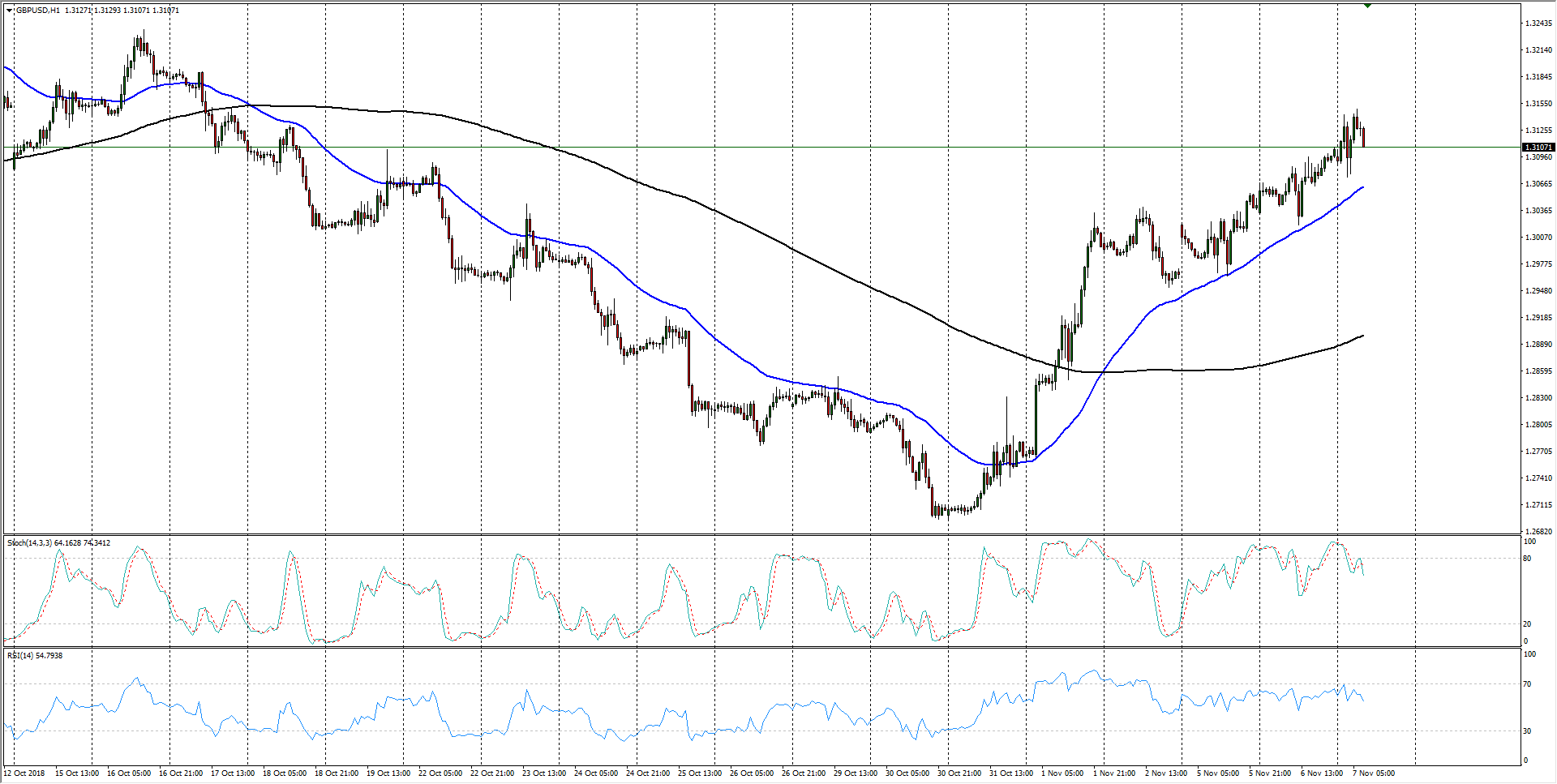

- The past twenty-four hours have seen the GBP/USD take steps higher, largely fueled by staunch hopes for a last-minute Brexit deal, but 1.3100 is proving to be something of a bear trap heading into the mid-week inflection point.

- GBP/USD Forecast: Bulls add Mid-Terms on top of Brexit hopes, 1.3250 eyed

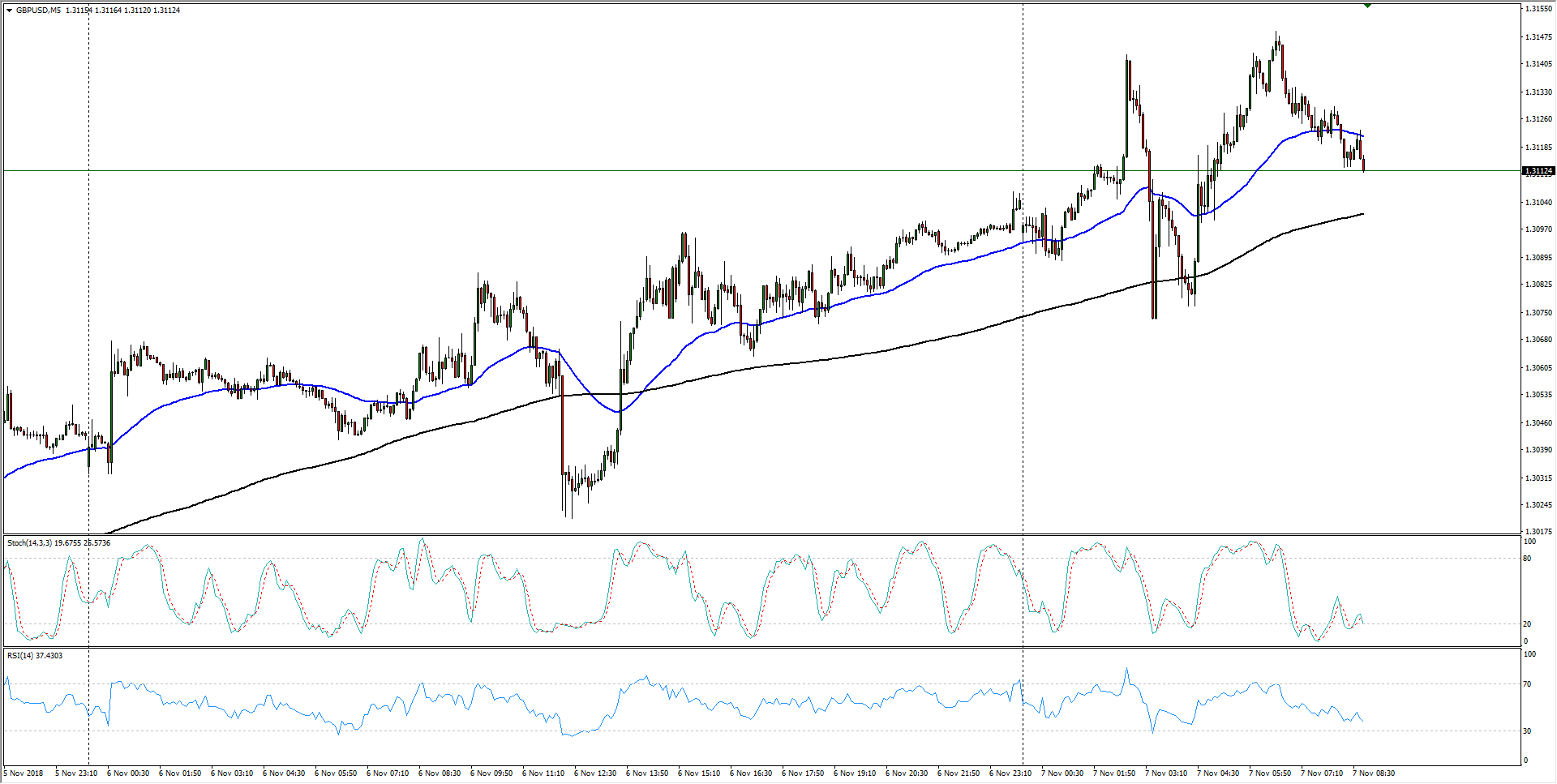

GBP/USD M5

- This week has marked an easy gainer for the Cable, lifting from opening prices near 1.3020, and sequential higher lows and providing a nice jumping-off point for reloading buys.

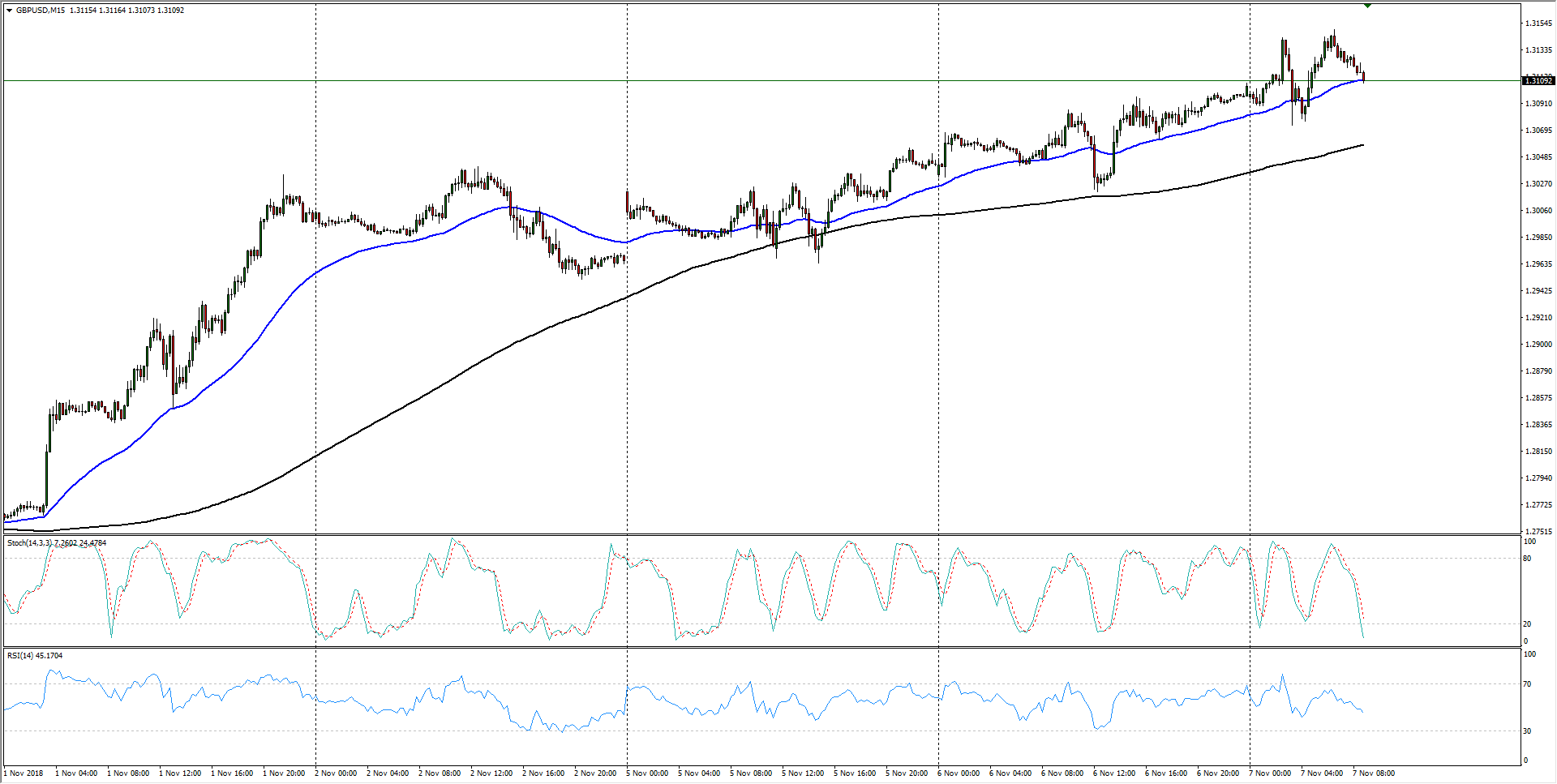

GBP/USD M15

- Despite recent bullish moves, the Cable market has been decidedly one-sided, with Brexit-hopeful bidders keeping the Sterling aloft from a recent bottom of 1.2700, and GBP/USD traders should be increasingly fearful of reality crashing in once again as the Cable heads for near-term highs at the 1.3200 handle.

GBP/USD H1

GBP/USD

Overview:

Last Price: 1.3116

Daily change: 19 pips

Daily change: 0.145%

Daily Open: 1.3097

Trends:

Daily SMA20: 1.2998

Daily SMA50: 1.3029

Daily SMA100: 1.3039

Daily SMA200: 1.3419

Levels:

Daily High: 1.31

Daily Low: 1.3021

Weekly High: 1.3042

Weekly Low: 1.2696

Monthly High: 1.326

Monthly Low: 1.2696

Daily Fibonacci 38.2%: 1.307

Daily Fibonacci 61.8%: 1.3051

Daily Pivot Point S1: 1.3045

Daily Pivot Point S2: 1.2993

Daily Pivot Point S3: 1.2966

Daily Pivot Point R1: 1.3125

Daily Pivot Point R2: 1.3152

Daily Pivot Point R3: 1.3204