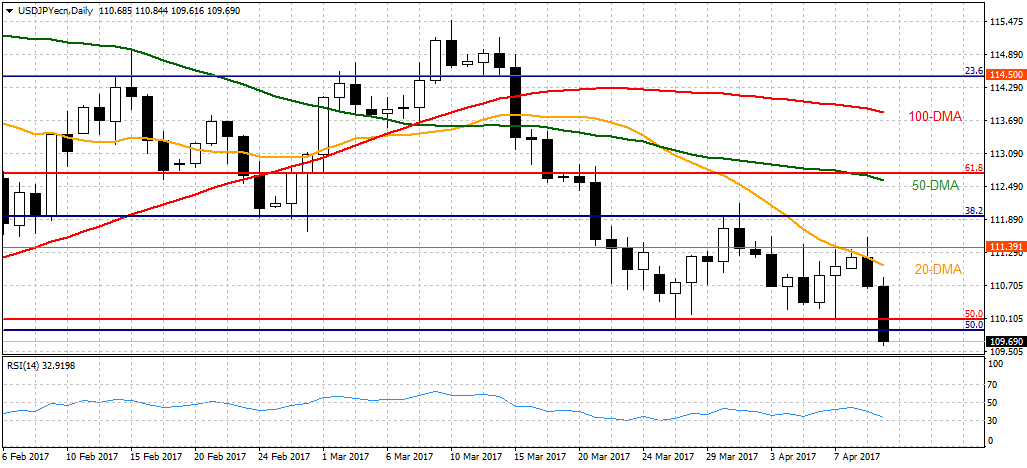

USD/JPY remains near multi-month lows

After falling to a new low since November 17 at 109.61, the USD/JPY has been unable to make a correction amid a lack of risk appetite. As of writing, the pair is losing 1.15% at 109.70.

Following a flat start to the day, the three major equity indexes in the United States came in under selling pressure as the geopolitical concerns hurt the investors' sentiment. Despite a sharp correction in crude oil prices, the S&P 500 is losing 0.3% while the Dow Jones Industrial Average is down 0.2%.

Additionally, the falling bond yields in the United States continue to wound the greenback. The flight to safety increased the demand for the U.S. Treasury bonds and pushed the yields lower. At the moment, the U.S. 10-year bond yield is at 2.3%, down 2.3% on the day. Minneapolis Fed's President Neel Kashkari's comments didn't help the greenback either as he suggested that the Fed could do better on reaching the goals of full employment and stable inflation.

Technical levels to consider

To the upside, 110 (psychological level) could be seen as the initial hurdle before 111.00/05 (psychological level/20-DMA) and 112.20 (Mar. 31 high). On the downside, a break below 109.60 (daily low) could aim for 109.00 (psychological level) and 108.55 (Nov. 17 low).