GBP/USD inches closer to 1.25 on USD weakness

The GBP/USD pair jumped higher to a fresh session high at 1.2491 during the first half of the NA session as the greenback was sold aggressively as the American session went underway. At the moment, the pair is up 0.5% at 1.2480.

The rising geopolitical concerns increase the demand for safer U.S. Treasuries, dragging the yields lower and putting pressure on the US Dollar Index. After spending the first half of the day in a tight channel just below the 101 mark, the index dropped to 100.50 before recovering some of the losses. At the moment, the index is at 100.58, losing 0.36% on the day. The 10-year U.S. bond yield is down 2.3% at 2.3%.

Earlier during the day, the consumer price inflation from the UK weakened, with the core inflation coming at 1.8% y/y, missing the expectations of 1.9%. Although the softer inflation data make the BoE less likely to tighten its monetary policy, the GBP sell-off didn't last long.

- UK annualized CPI stays unchanged in March, core figures disappoint

Now markets turn their attention to FOMC's Kashkari's speech. Kashkari usually stands out among the members of the FOMC with his dovish remarks, which generally put selling pressure on the greenback.

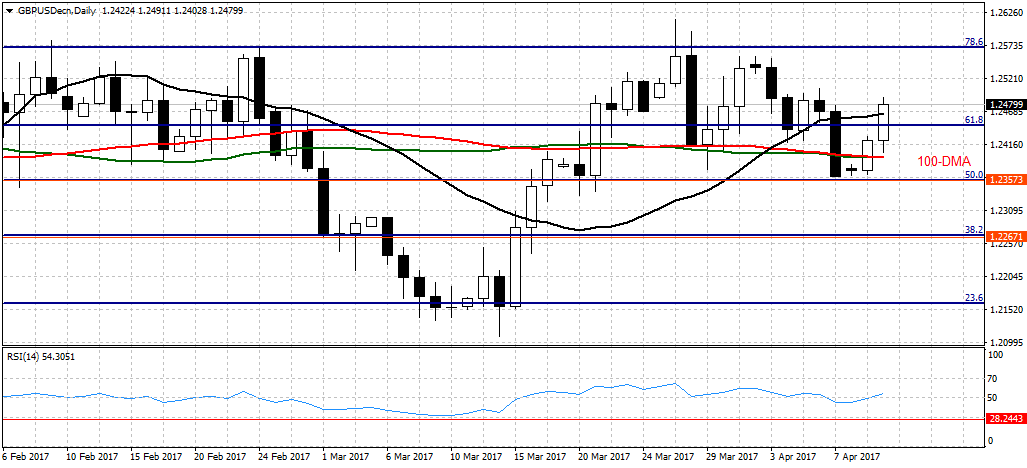

Technical outlook

The initial resistance for the pair aligns at 1.2560 (Mar. 31 high) followed by 1.2615 (Mar. 27 high) and 1.2700 (psychological level). On the flip side, supports could be found at 1.2465 (20-DMA), 1.2400 (psychological level) and 1.2360 (Fib. 50% of Dec/Jan fall).

- GBP/USD short-term resistance at 1.2628 – Commerzbank