AUDUSD capped below 0.7680; roaring US data accelerates dollar recovery

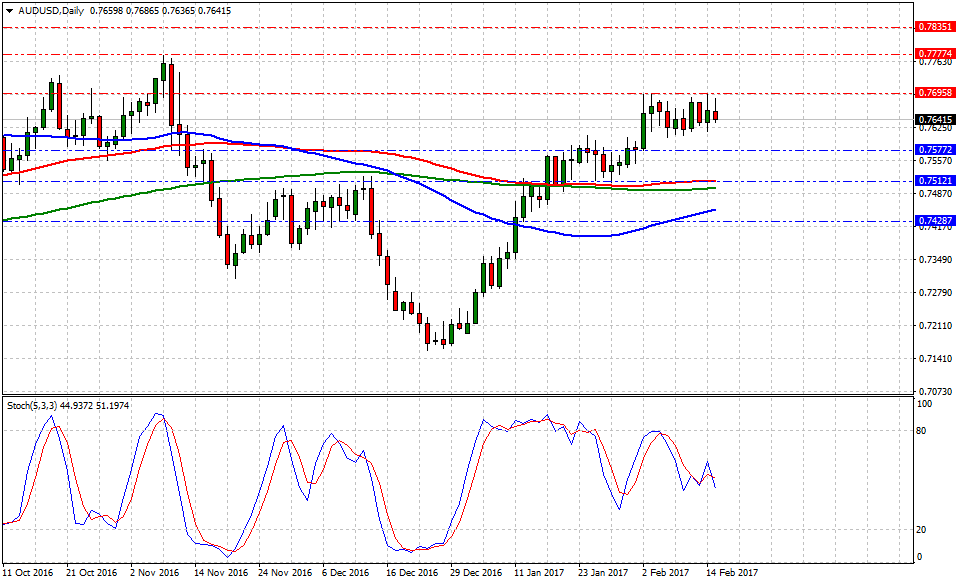

Currently, AUD/USD is trading at 0.7643, down -0.26% or (19)-pips on the day, having posted a daily high at 0.7687 and low at 0.7636.

Today's US economic docket was jam-packed as market participants were exposed to multiple 'high impact' news releases that added the extra-boost the US dollar needed for weeks. Furthermore, Fed's Yellen testimony confirmed how the Federal Reserve is not behind the curve and 3-hikes are doable in 2017; a March hike?

The greenback's bullish narrative continued as the Consumer Price Index YoY (CPI) printed 'a better than expected' 2.5% figure, 0.4% more than previous and 0.1% above consensus. Although, one can argue a marginal increment, the result indicates ongoing and positive growth. On the other hand, long-aussie traders have played China's stable outlook and aligned their bets as in the next 10-hours the Employment change and Unemployment rate hit the markets.

Historical data available for traders and investors indicates during the last 7-weeks that AUD/USD pair, a commodity-linked currency, had the best trading day at +1.18% (Jan.17) or 89-pips, and the worst at -0.81% (Jan.18) or (61)-pips.

Technical levels to consider

In terms of technical levels, upside barriers are aligned at 0.7695 (high Feb.2-Feb.14), then at 0.7777 (high Nov.8) and above that at 0.7834 (high April.21). While supports are aligned at 0.7576 (low Feb.2), later at 0.7512 (100-DMA) and below that at 0.7450 (50-DMA). On the other hand, Stochastic Oscillator (5,3,3) seems to revert its previous intentions to push higher and turns bearish for now. Therefore, there is evidence to expect further Aussie losses where bears may expect to drag the pair lower towards 0.7512 handle.

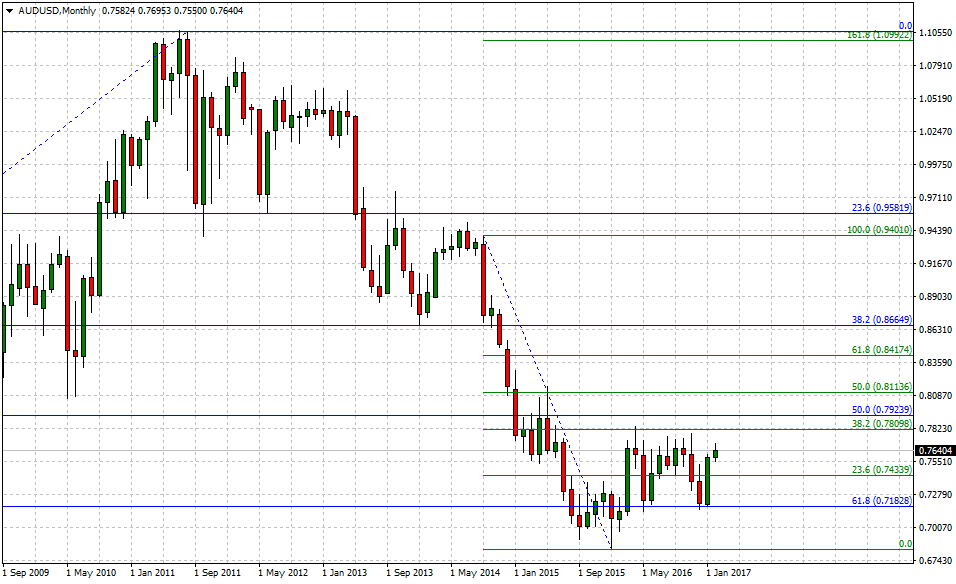

On the long term view, if 0.7834 (high April, 2016) is in fact, a relevant top, then the upside is limited at 0.7809 (short-term 38.2% Fib). Furthermore, if the RBA has 'no ammo' nor tangible reasons to increase rates in 2017, the interest rate advantage should decreased organically as the Federal Reserve continues increasing rates with 3-hikes in the next 16-months. To the downside, supports are aligned at 0.7433 (short-term 23.6% Fib), later at 0.7182 (reverse long-term 61.8% Fib) and below that back to 0.6826 (low Jan.2016).

AUD/USD analysis: rejected from 0.7700, but downside still limited