Back

17 Jul 2023

Crude Oil Futures: Door open to extra correction

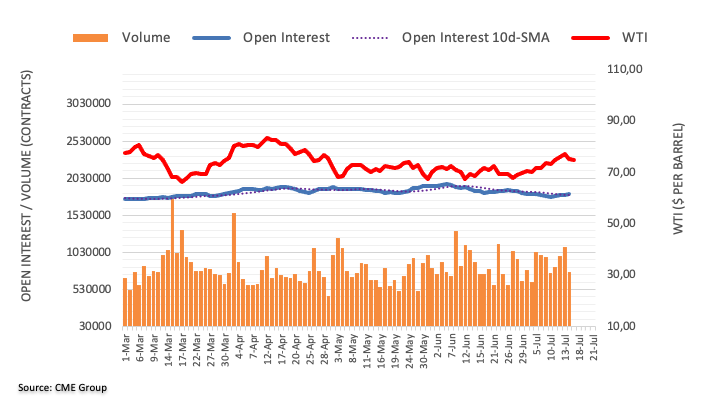

CME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the fourth consecutive session on Friday, this time by around 8.1K contracts. Volume, instead, went down by around 335.6K contracts after three daily builds in a row.

WTI meets resistance around the 200-day SMA

Prices of WTI corrected markedly lower after flirting with the key 200-day SMA above the $77.00 per barrel on Friday. The downtick was on the back of increasing open interest and exposes further declines in the very near term, with the immediate target at the transitory 100-day SMA around $73.50.